BTC open interest at YTD high doesn’t move prices, but traders can rely on bots

Bitcoin (BTC) open interest has been ascending for months, suggesting the market’s resilience even though the largest cryptocurrency by market capitalization hasn’t consolidated above the psychological level of $30,000.

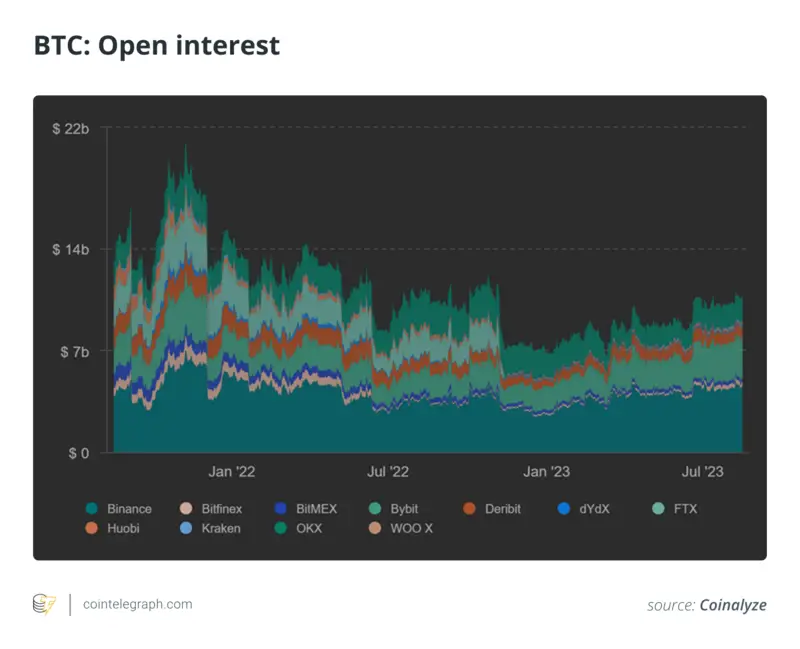

At the beginning of August 2023, Coinalyze data showed that the Bitcoin open interest figure returned to break above $10 billion, maintaining close to the highest level since the beginning of May 2022. The figure updated the year-to-date high on Aug. 9.

Open interest is a metric that reflects the volume of unsettled futures, potentially indicating the confidence of the market to leave positions open. This is an important gauge, given that a good chunk of Bitcoin trading occurs on futures trading platforms, such as those offered by Binance, Bybit, OKX and the Chicago Mercantile Exchange (CME).

Futures contracts enable traders to speculate on the price of assets without their direct or physical involvement. While Bitcoin doesn’t change hands during futures trading, these financial instruments can influence market trends by providing insights into the general sentiment.

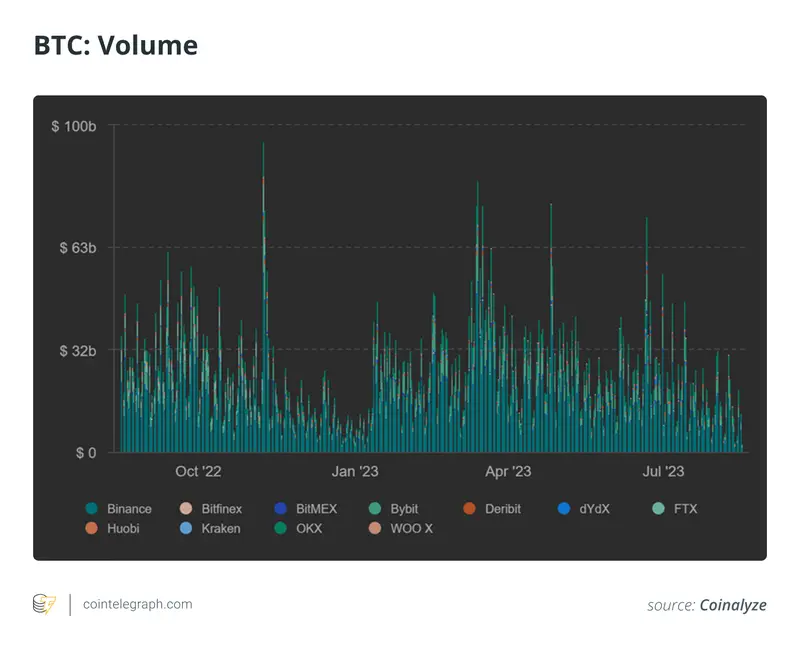

While the open interest figure has been on the rise, leaving the sour taste of the FTX collapse behind, Bitcoin futures trading volume has declined since March of this year, meaning that traders are less active than in the first quarter.

These market conditions may suggest that the accumulating open interest is coming from institutional investors.

What drives the Bitcoin market today?

An expanding open interest in Bitcoin generally aligns with a surge in its value. Yet the current scenario is different, as the cryptocurrency faces challenges in maintaining a position above $30,000.

Several events are hindering a fresh bullish move. Firstly, investors are not confident that the United States Securities and Exchange Commission will have approved a Bitcoin spot exchange-traded fund (ETF) by the end of this year. The financial watchdog is reviewing several applications from BlackRock, ARK Invest, VanEck, Bitwise, Fidelity and Galaxy Digital.

Giving at least one of these candidates the green light will provide much hope for the rest of the applications, which could transform into tremendous support for another rally.

Secondly, tightening the monetary policy to curb inflation puts pressure on economic growth. While raising interest rates is a necessary step for the Fed to put a break on loose money, the risk of an economic recession is a high price to pay. Despite running on a global, decentralized network of nodes, this also impacts Bitcoin, as institutional investors are risk-averse during economic struggles.

How to trade Bitcoin with maximum efficiency

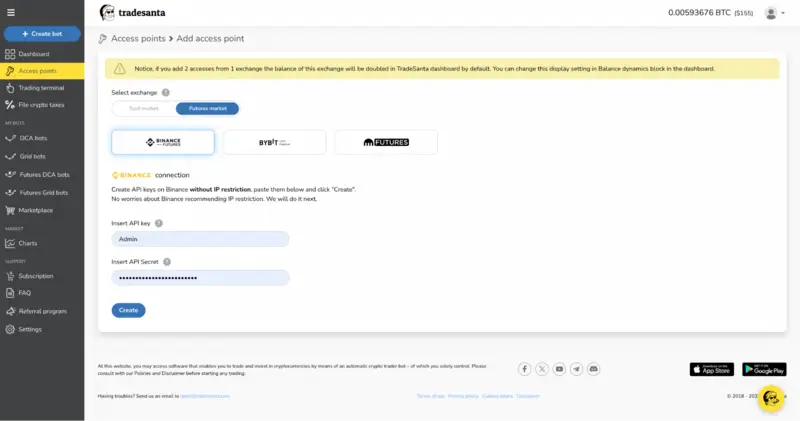

While trading Bitcoin during periods of low volatility, horizontal trends and uncertainty is a big challenge, using tested trading bots and algorithmic strategies might do the trick. TradeSanta bot emerges as a dependable platform where all these solutions are easily accessible, providing trading bots that work both in spot and in futures markets. This automated trading platform has many features that help traders reduce human errors and manage their crypto assets more efficiently during different market conditions.

Accumulating Bitcoin open interest hints at increased confidence despite market struggles, which may lay the foundation for the next bullish momentum. Traders can leverage a potential uptrend with the help of TradeSanta’s cloud-based platform and its wide range of risk management tools like stop loss, trailing stop loss, and TradingView stop signals, and take profit targets such as simple or trailing take profit trigger. Even if a bullish move doesn’t materialize, you can use this platform during downtrends by shorting your positions.

Note that TradeSanta bots don’t make decisions for you. Instead, they automate processes according to users’ predetermined strategies, settings and TradingView technical indicators. This can be a significant boost in your trading experience, although you’re the one who pulls the strings. Less experienced traders can leverage the platform’s copy trading feature, enabling them to mimic successful traders’ strategies or use starter preset parameters: low-risk settings based on previous trading history.

Thanks to TradeSanta bots, users can also automate trading processes on major derivatives platforms, such as Binance Futures, Bybit Perpetual, and Kraken Futures. It supports major spot exchanges as well. The platform also offers its trading terminal, including all the tools needed for technical analysis of indicators.

If you want to trade Bitcoin futures, you can explore TradeSanta’s bot marketplace and use filters to access the futures market. The platform supports over 3,700 coins, so there is always something to trade. Importantly, futures trading is available to TradeSanta users with a Maximum subscription, which is currently part of a promotional offer slicing the costs by half with an additional free year.

The steady rise in Bitcoin’s open interest suggests a resilient crypto market despite a lack of consolidation above the $30,000 level. This reflects potential confidence from institutional investors, even as futures trading volume declines. While current hindrances may delay a bullish move, platforms like TradeSanta offer advanced tools for traders to navigate these complex market conditions.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment